Should I Sell My Business Now: Things to Consider

2 min, 30 second read

It’s no secret that the business world is changing at an unprecedented pace. From new technologies and shifting customer demands, to more recent challenges with labor reliability, the landscape of business is always evolving.

This means it’s increasingly imperative for every owner of any type of company to keep their business as innovative and forward-thinking as possible. Afterall if your company isn’t able to stay ahead of the curve, it’s going to become outdated sooner rather than later, and lose desirability, aka value. Therefore, if you own a business right now and feel uncertain about whether or not it’s time to sell, read on for a few things to keep in mind before making a decision.

1. Know Why It’s Time to Sell

First, the economy. While the economy has improved since the onset of the pandemic, talks of recession are now everywhere, leaving the majority of the country pondering next steps and experiencing multiple levels of economic uncertainty. For many, this can mean that the hard work of business ownership is starting to feel especially challenging. If you own a company that has experienced a historically successful multi-year run, yet are feeling drained, burned out or your personal trajectory toward what you poured your heart and soul into has shifted, it could be time to effectuate a sale and go out on top.

2. What Goals Will You Set for Selling Your Business

The market itself is always the FINAL and most definitive gauge of sale value. A formal business valuation is an indicator…An opinion. It’s helpful for a seller to retain realistic expectations and remain engaged. A good broker rep offers under-rated support; keeping lines of communication open, feathers unruffled and confidence levels between parties high. Certain times there are deals in play when a good broker working for you determines it’s not the right deal and it could be best to cut bait and start again. A good broker won’t drag you through the wrong deal for their individual interest.

3. Realize That Selling a Business Isn’t Easy

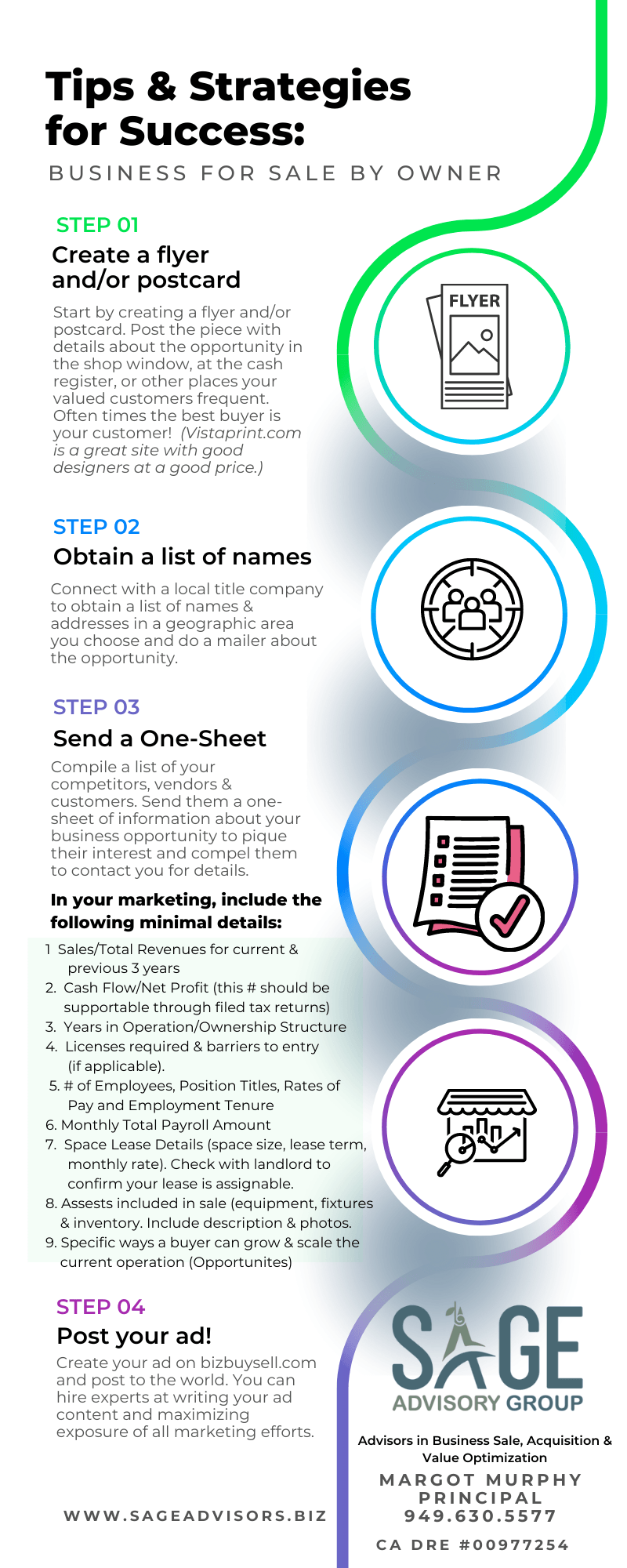

Selling your company is not as simple as posting advertisements, handing over ownership and walking away with a payout. Selling a business takes strong seller commitment and engagement. But the process must be balanced so you can continue to operate your business to ensure it remains profitable during sale. A good sell-side broker juggles myriad tasks and attention needed.

These are milestone phases of selling a business:

- Packaging the Opportunity: During this phase your broker will package your business to present to the market, advertise, source leads, cold-call, network, talk with and coordinate meetings with worthy interested parties. This is the most time-consuming part of selling a business. And a crucial part. If mishandled, you will miss attracting the right buyer.

- Due Diligence / The Vetting Process. You will interview buyers, just as they interview you. Your broker will head up necessary due diligence recommended for you, as well as coordinate what information a buyer under contract will need to move through to a final purchase commitment.

- Closing: Almost every single deal will be additionally legitimized through a formal, specialized escrow process. Whether an asset sale or a stock sale transfer, a good broker, along with your CPA, will guide you on which sale outcome is best suited for you from a tax perspective.

4. Consider who you Hire to Represent your Sale

Know you will be engaged with your broker for several, if not many months. Do you feel a sense of trust with them? Do you align with their energy? Do you feel assured they will unconditionally represent your best and final interest…At all times? There are many qualified, experienced business intermediaries serving business sellers and buyers. Interview several.

Margot Murphy is the Principal Broker of Sage Advisory Group, a California Business Brokerage firm which acts as a marketing engine, sale facilitator and sell-side representative for business owners and corporations seeking to transfer sale of companies generating $2MM - $15MM annual revenue.

To schedule a confidential, no-obligation consultation, contact Margot today at https://www.sageadvisors.biz/schedule-a-consultation or call her direct at 949-630-5577.